Rural Home Heating HVO

Ref Rural Home Heating – Response to Government Proposal by UKIFDA, OFTEC & Future Ready Fuel

GOVERNMENT PROPOSALS

The government has proposed that from 2026 off-grid homes will no longer be able to replace existing oil boilers and will instead, as part of a “natural replacement cycle”, start to transition to lower carbon technologies.

Low temperature air source heat pumps are proposed as the lead replacement technology (the “heat pump first approach”) where it is “reasonably practicable” to install these systems.

This approach is based on a theoretical assumption that 80% of existing oil-heated homes can be converted without major modifications to insulation and wiring.

It is also proposed that by the end of 2030s, the use of fossil-based heating will be banned.

“Our review of the evidence leads us to conclude that delivering low carbon heat through a heat pump first approach will be extremely difficult to achieve based on practical, technical and cost grounds”. – UKIFDA & OFTEC

A broader range of technologies needs to be employed to reflect the types of homes people live in, the way they purchase heating, the carbon reduction potential, the affordability of those solutions, and above all else, fundamental fairness to all consumers.

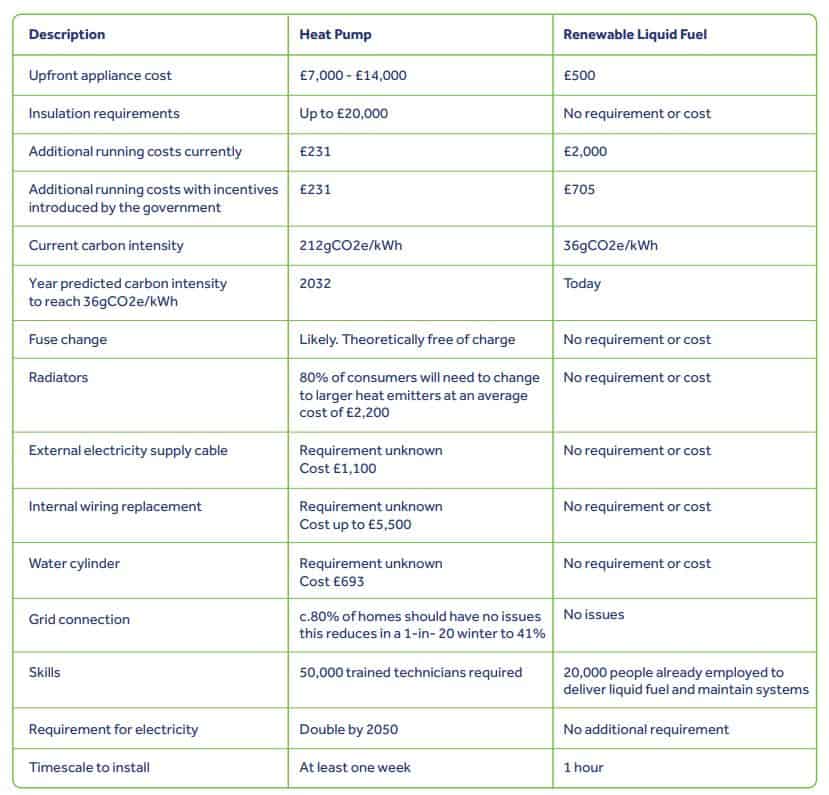

1. | Appliance replacement is unnecessary, costly and is not the quickest carbon reduction solution.

2. | The policy does not represent consumer choice or fairness.

3. | There is little evidence to support the claim that 80% of oil-heated homes are heat pump ready.

4. | There is no definition of “reasonably practicable”.

5. | The policy does not reflect how appliances are purchased.

6. | There is a lack of skilled and qualified heat pump installers.

7. | Significant progress can be made by promoting renewable liquid fuels and harmonising incentive programmes.

Our view is that oil-heated homes should be treated as a priority for conversion to a renewable liquid fuel replacement because of the lack of a viable alternative to decarbonise the sector.

INDUSTRY DEMONSTARTION PROJECT

On 26th November 2020, a bungalow in the small village of Scorrier in Cornwall was the first UK home to be converted to a renewable liquid fuel called Hydrotreated Vegetable Oil (HVO). The property previously relied on oil for heating. In order to switch the property to the new HVO supply, the local fuel distributor removed the fossil heating oil from the oil tank, installed an HVO compatible nozzle and made some pump pressure adjustments to the oil boiler. The process took less than an hour and around £500 in cost to change.

During the winter of 2020/21, a further 19 properties were converted across the UK. In late October 2021, The Future Ready Fuel campaign launched the next phase of the renewable liquid fuel demonstration project. The second phase broadens the geographic spread and also, for the first time, allows the industry to test the logistics of what could be a bigger transition to renewable liquid fuels over the coming years. Good progress has been made by the 15 fuel distributors involved in the project and the many dedicated heating technicians.

By early 2022 there will be 200 homes and premises using HVO in the UK. HVO has been used in several non-domestic settings, including a church, school, and the buildings used for COP26 in Glasgow. The industry is currently assessing a significant number of other non-domestic buildings in the UK. Currently, as expected, no major technical issues have been encountered. HVO has a carbon intensity of 36gCO2e/kWh. This compares to 212gCO2e/kWh for electricity and 298g CO2e/kWh for heating oil.

The government’s proposed policy is based on replacing existing appliances and equipment. It ignores the obvious benefits of a rapid deployment of renewable liquid fuels, which gives a c.88% reduction in carbon emissions and removes the need for large up-front cost and significant disruption.

Our analysis shows that to install and make an oil-heated home ready for a heat pump will cost on average £20,500.

In comparison, the average upfront cost to replace heating oil with a renewable alternative is £500.

These costs are backed up by evidence given to parliament.

Electric heating appliances, such as heat pumps, are only low-carbon if the electricity used to run them is generated from low-carbon sources.

The carbon intensity of electricity is predicted to be much higher than HVO in the next 10 years. Our independent analysis shows that the greatest carbon saving can be achieved by moving to a liquid renewable fuel, which saves 50% more carbon across an appliance cycle atsignificantly less cost.

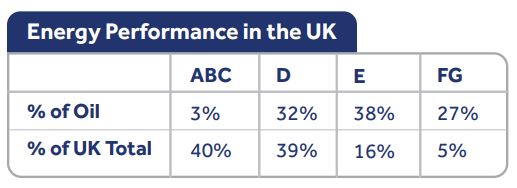

Oil heated off-grid homes are more likely to have been built before 1919 and be detached. There is a strong link between dwelling characteristics and energy efficiency rating with detached and pre-1919 properties recording the lowest energy efficiency profile.

The heat loss in a home and the energy efficiency of the home

UK homes lose heat significantly faster than our European neighbours, even when factoring in outside temperature. With an indoor temperature of 20°C and an outside temperature of 0°C, UK homes are likely to lo

This is an important point; traditional boilers work well in poorly insulated buildings because they can react quickly to falls in temperature. Low temperature air source heat pump (ASHP) systems respond more slowly to temperature changes and work best when installed in well-insulated buildings where they are kept on for longer periods.

As a result, it’s desirable that a home is well-insulated and energy efficient before a heat pump is installed. It is widely accepted that an EPC (current measure of a home’s energy efficiency) band C is a sensible minimum.

The current energy performance of oil-heated homes in the UK compared to those on the grid is summarised here

The government has already recognised that homes may require upgrading before a heat pump is installed. For example, in the government’s Renewable Heating Incentive (RHI) scheme, Ofgem required an EPC certificate and, if the assessor recommendations “include cavity wall and/or loft insulation, you’ll need to make these improvements and then get a new EPC before we can continue with your application”.

This methodology is used again for the new Boiler Upgrade Scheme, recently launched to encourage heat pumps, which specifically excludes buildings that have an EPC recommendation report that requires loft or cavity wall insulation to be installed.

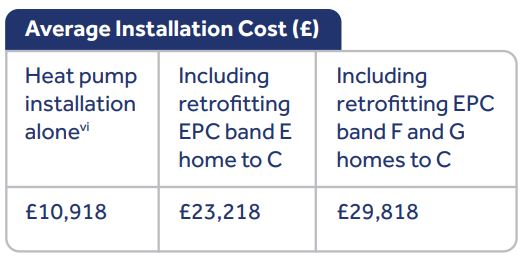

The upfront costs of the various alternatives.

While well-insulated off-gas grid homes will be able to convert to heat pumps with relatively little additional cost beyond the installation itself, less well-insulated homes will require significant additional retrofit work. The average cost of a heat pump installation reported to MCS (Microgeneration Certification Scheme) under the Renewable Heat Incentive (RHI) scheme in 2019 is £10,918.

Therefore, an air source heat pump costs approximately four times as much to install as an oil boiler. Additional energy efficiency measures will be necessary for homes in the lowest energy efficiency brands.

In September 2020, the Secretary of State for Business Energy and Industrial Strategy estimated that the costs of improving an average home that is off the gas grid to band C from a band E would be £12,300, and from a band F and G £18,300.

These numbers have led the Future Ready Fuel team to the following numbers:

Therefore, on average, the heat pump installation cost for an oil-heated home in the UK will be £20,500.

These numbers approximate very well to the numbers provided to a recent parliamentary enquiry commissioned by the Environmental Audit Committee, which highlighted real-life costs in Leeds of £17,700 to £27,400.

The carbon reduction potential

Electric heating appliances, such as heat pumps, offer potentially higher operating efficiencies, but they are only truly low-carbon if the electricity used to run them is generated from low-carbon sources.

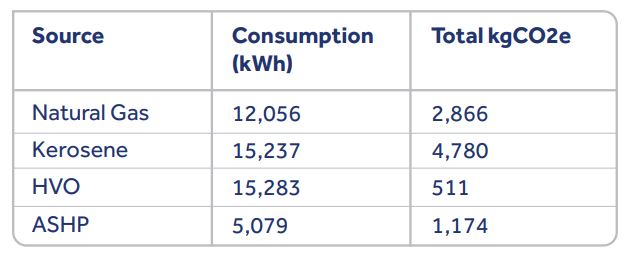

The current carbon intensity conversion factors used by the governmentviii are 212gCO2e/kWh for electricity and 298g CO2e/kWh for heating oil. HVO has a carbon intensity of 36g CO2e/kWh.

The decarbonisation potential of heat pumps depends significantly on the ability of the electricity grid to decarbonise. In 2019 the final full year before the pandemic, of electricity generated, gas accounted for 40.9% whilst coal accounted or only 2.1%.

An average UK oil-heated home produces 5.3 metric tonnes of carbon per year. HVO offers a saving of c.88%. Under the Climate Change Committee’s balanced pathway scenario, it will be at least 2032 before the carbon intensity of electricity will be below that which HVO can deliver today.

Therefore, HVO would have a much greater initial annual impact on emissions than converting homes to heat pumps.

UKIFDA and OFTEC commissioned independent analysis with respect to the current carbon intensity of various home heating options:

This analysis shows there is a significant carbon saving moving from an oil-heated system to an ASHP (Air Source Heat Pump).

However, the greater saving is made by moving to a liquid renewable fuel, which can be achieved at least 10 years earlier than the ASHP option.

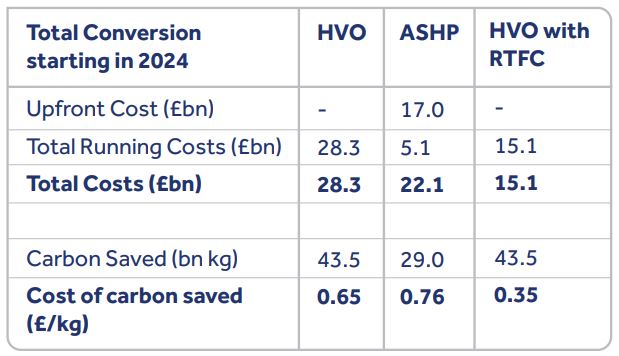

UKIFDA and OFTEC have taken the independent analysis one step further and have mapped realistic and highly conservative rollout scenarios to ascertain the total carbon saved and the cost to the consumer.

We have forecast this across 2024 to 2037, equivalent of a whole appliance cycle.

HVO currently is more expensive than heating oil for customers. But customers who use HVO for transport vehicles, mobile machinery or aircraft receive a significant cost reduction per litre (currently c. 80p/litre).

Our analysis illustrates that the HVO option across the cycle shows an extra 50% more carbon saved at significantly less cost per carbon.

The proposed government policy could be seen as actively discriminating against rural households if they are not given a choice.

For example, from 2026, two households in otherwise identical houses will be treated differently if one uses mains gas and the other oil. The former will be able to replace a life-expired gas boiler with another one – and can continue to do so until 2035. The latter must, in most cases, fit a heat pump at currently four times the cost of a boiler.

The government hopes the cost of heat pumps will fall between 25% and 50% by 2025. The average reported cost of a heat pump installation rose 37% between 2011 and 2019 to £11,000. With inflation at over 5%, the prediction that prices will fall by 50% in three years seems extremely optimistic. Even if prices do fall, a heat pump will still cost at least twice as much as an oil boiler.

There is a significant risk that the purpose of the proposed policy will be interpreted, not on the basis of a rational approach to reducing emissions as rapidly as possible, but purely to facilitate the development of the heat pump market. The government currently plans to regulate before it knows if the cost reductions can be achieved, potentially exposing oil-heated households to the risk of unacceptable costs.

The excessively high upfront costs of heat pumps should be considered in the context of disposable household income.

Based on data published by the Office for National Statistics (ONS) under Regional Gross Disposable Household Income, UK: 1997 to 2019, the UK average disposable income is £21,433, excluding London (on the basis of having minimal oil-heated homes) this average is reduced to £20,000.

Given that gross disposable household income excludes day-to-day costs, mortgages etc., the average cost of a heat pump and modifications at £20,500 is going to be extremely hard to find for most households. Even where no additional insulation is needed the high cost of a typical heat pump installation will be an unaffordable burden for most households.

Given that a family living in an on-gas-grid home will not face these high costs until at least 2035, we think this additional financial burden will be considered unfair by most reasonable people. Rural households will face unacceptably high costs if these anticipated cost savings are not achieved, particularly in distress purchase scenarios.

We are concerned by the comments made by government in the impact assessment attached to the related nondomestic consultation – which has identical aims and states “Deploying low carbon technologies through the 2020s, in particular heat pumps, through this policy will also increase the size of the electrification market to support the future decarbonisation of other segments of the building stock. This is essential to keep the electrification option open for buildings that are on the natural gas grid, should low carbon hydrogen boilers prove unviable.”

By comparison, converting an existing oil boiler to run on HVO is quick, simple, and relatively cheap (average £500). It would potentially enable a faster conversion rate to low carbon heat than can be achieved by using only the natural cycle of boiler replacements. Households can be incentivised to adopt the new fuel to encourage uptake.

We are concerned about the government’s claim that c.80% of existing off-grid homes are ‘low temperature heat pump ready’ as the evidence base is weak and incomplete.

In making this claim, the government is relying on several theoretically based desktop studies.

In addition to the different Characteristics of oil-heated homes, heat loss and the insulation required, installing heat pumps will increase electricity use.

Consequently, the requirement on the grid, for both high and low voltages will increase substantially. A big concern is how grid systems in rural areas will cope, the timescale concerning upgrades, and the ultimate cost to the consumer.

In addition, research has shown that there are other considerations such as fuses, wiring to and within homes, radiator replacement, and installation of water storage tanks that need to be assessed before a heat pump can be installed, adding significant extra costs.

Additional costs and considerations

In the evidence used by the government to back up its claim that 80% of off-grid homes can install a heat pump without modification, the following issues were not considered.

Fuse limits and wiring

44% of oil dwellings were built before 1919, and older properties are more likely to have a 60A fuse. As indicated by the government, this will need to be upgraded to 100 A which “in theory” will allow for heat pump use.

A government commissioned report comments, “A related issue is the cost and complexity of upgrading the fuse limit. If the electricity supply cable to the dwelling is of sufficient size, the DNOs (electricity network owners) will provide a fuse upgrade free of charge when electric heating is installed in a dwelling. However, if the supply cable is not sufficient to handle the increased amperage, the cost of the new supply cable must be paid by the dwelling owner. The cost of this is expected to be similar to that of a new connection to a domestic dwelling, which is quoted at a standard rate of £1,100 for a 15m connection across the DNOs. More isolated dwellings may have a higher charge as a longer connection cable will be needed.”

By comparison, converting an existing oil boiler to run on HVO involves no fuse changes

The same report also comments that the quality and age of the existing wiring in individual dwellings will also impact the cost of conversion.

New consumer units and extensive re-wiring may be needed in dwellings where these are no longer compliant with building regulations.

Re-wiring will approximately double the installation cost in many cases and increase the system lifetime costs by around 10%.

This situation may affect a substantial fraction of the off-gas grid stock, as over 50% of England’s oil-heated dwellings were constructed before 1945.

Some of these dwellings may already have had substantial improvements to their original wiring. The report advises, “Further detail on the state of the wiring in the off-gas grid stock would allow a more detailed assessment of the likely upgrade costs.” The report quotes rewiring of a 4-bedroom home as being £3,750 to £5,500 and taking 10 to 15 days to complete.

By comparison, converting an existing oil boiler to run on HVO involves no major wiring changes

Radiators

The government’s proposal to prioritise low temperature heat pump systems means that, in virtually all cases, the existing heat emitters, i.e., radiators, will need to be upgraded.

In its recent evidence gathering into heat distribution systems, government found:xii “Analysis of the sizes of heat distribution systems has revealed that 10% of UK dwellings with wet central heating systems can meet heat demand (kW) at a 55°C flow temperature, and 1% with a 45°C flow temperature, on a peak heating day, with no changes to their heat distribution system.

These results are significant, since they quantify the changes required to dwellings when low temperature heat sources are installed. Typical costs for retrofitting heat emitters for low temperature heating are £1,700 for a 1-2-bedroom house, £2,200 for a 3-bedroom house”.

The report concludes that “further work will be required to better understand the impacts of changing heat distribution systems in dwellings to lower flow temperatures”.

This conclusion is supported in another government commissioned report “Based on interviews with heat pump manufacturers, installers, utilities and existing Delta-EE insight, the existing heat emitters need to be replaced (or additional emitters added) more than 80% of the time when installing a low temperature heat pump. Some sources claim that in all cases they need to replace the existing radiators when installing a low temperature system.”

By comparison, converting an existing oil boiler to run on HVO involves no radiator changes.

Hot water cylinders/tanks

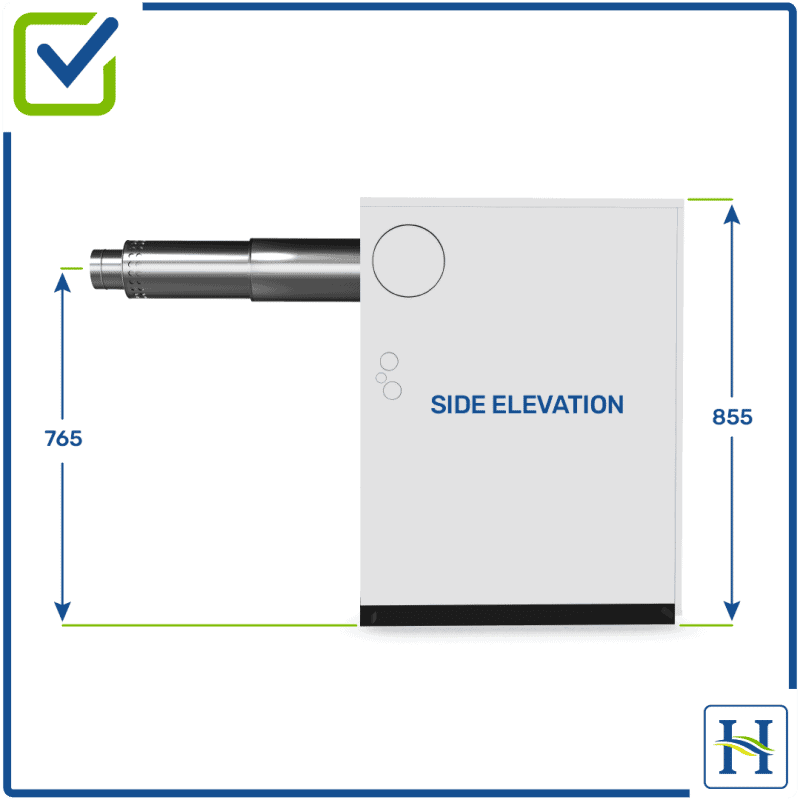

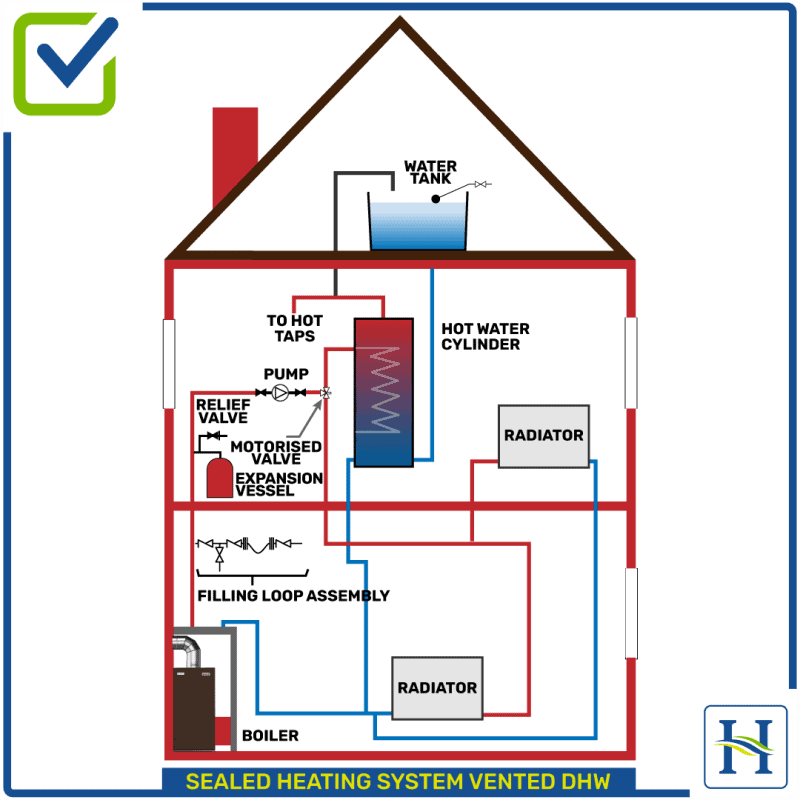

Many oil-heated customers will have converted to a combination boiler, which delivers hot water at the point of need. Heat pumps require a move back to hot water storage. It is estimated xiv in a report for government that somewhere between 16% and 22% of oil-heated homes in England may require the installation of a hot water cylinder or tank.

The number in Wales is significantly higher at 52%, suggesting the English numbers require updating.

This is backed up by evidence from OFTEC’s boiler manufacturing members suggesting that approximately 50% of oil boilers installed since 2010 are of this type.

A hot water cylinder costs between £500 and £693.

By comparison, converting an existing oil boiler to run on HVO involves no cylinder changes.

The adequacy of the local grid system

Installing heat pumps means that homes will increase their electricity use and the requirement on the grid for both high and low voltages will increase substantially. A big concern is how these grid systems in rural areas will cope, the timescales concerning upgrades (if possible), and the ultimate cost to the consumer.

This situation was researched for government in 2018. It was found that on the average peak winter day, the LV (low voltage) network could support heat pumps operating in 82% of dwellings. This was reduced to 41% of dwellings on a 1-in-20 winter peak day. 70% of LV substations required reinforcement to accommodate the additional load from electric heating. The report also sensibly considered the grid operating at 90% capacity in order to provide redundancy.

At this level, nearly 25% of the networks would be overloaded on an average peak winter day and c.35% on a 1-in-20 day where properties used an ASHP.

In its 2020 Future Energy Scenario (FES) report, National Grid estimated that up to 1,008,215 off-grid properties will require a solution other than heat pumps due to the high cost of local network upgrades.

By comparison, converting an existing oil boiler to run on HVO involves no changes to grid requirements.

Planning constraints

From 1 December 2011 the installation of an air source heat pump on domestic premises is considered to be permitted development i.e., not needing an application for planning permission, provided certain conditions are met.

One of these conditions – on land within a conservation Area or World Heritage Site – is that the air source heat pump must not be installed on a wall or roof which fronts a highway or be nearer to any highway which bounds the property than any part of the building.

Around 20% of older, pre-1919 homes are in conservation areas. Given that 44% of oil-heated homes were built pre 1919, many will require planning permission for a heat pump.

Given that a renewable liquid fuel is a drop-in replacement for home heating oil there are no known planning issues.

There needs to be a definition of ‘reasonably practicable’ before a true response to this policy can be given. The government should provide a definition and consult upon it before any further decisions are made.

A fair transition to low carbon heating must be a fundamental principle of government policy and is explicitly stated as such in the Heat and Buildings Strategy.

Therefore, we assume the government will wish to ensure that off-grid households are not unreasonably disadvantaged by its decision to ignore the differences between off-grid homes and those on the gas grid.

In our view “reasonably practicable” should include an assessment of:

The type of home, age, location and characteristics.

The heat loss in a home and the energy efficiency of the home.

The upfront costs of the various alternatives and whether they are affordable.

The additional costs of improving the home to an appropriate standard to take a technology option including energy efficiency measures, wiring, fuse requirements, and additional items such as water tanks.

The adequacy and resilience of the local grid system.

Planning constraints.

The carbon reduction potential.

The ongoing costs.

The infrastructure and resources required for each technology solution and whether they are in place.

It is clear from consumer research we have undertaken that off-gas grid households require low carbon solutions that are cost effective, affordable and practical. The present policy proposals do not meet this definition, and there is a risk that households will try to hold on to their existing fossil fuel heating systems due to the high costs involved in switching to heat pumps.

If large numbers of homes continue to use fossil fuels into the later 2030s, not only will the government’s decarbonisation plans be undermined, but also it will be difficult to end the use of fossil fuels such as kerosene in an orderly way.

Therefore, it is essential that government adopts a technology inclusive approach and ensures that a range of appropriate solutions is available for off-gas grid households.

We believe that the government can provide a number of solutions to help ensure that renewable liquid fuels play an important role in decarbonising the off-grid oil heated sector.

Our research shows that 57% of all oil boilers purchased are made in distress.

Our research shows that 57% of all oil boilers purchased are made in distress.

Typically, in these situations the aim, and in the case of rented accommodation backed by a legal obligation, is to restore heating as quickly as possible.

The additional time and disruption to plan and carry out a heat pump installation will cause significant difficulties for homes already in distress purchase situations.

The level of preparation required was highlighted by the Energy System Catapult:

“It often makes sense to improve the energy efficiency of homes before installing low carbon heating systems. This can reduce the amount of energy needed to deliver the comfort people want.

It can be particularly important for older homes because they are less energy efficient. This can take several months to organise and complete. If a heating system breaks in the middle of winter, people will want a new heating system as soon as possible. That means it probably makes sense to prepare homes, so they are ready for low carbon heating when people decide to replace their systems. There are no robust statistics on exactly how many homes will need

preparing. It depends on many things: how well insulated the building already is, how the plumbing is arranged and what temperatures the residents find comfortable. What we do know is that millions of homes will probably need some form of preparation.”

By 2025, 12,400 heat pump installers will be needed and 50,200 by 2030. There is currently little evidence to show how this will be achieved.

Analysis conducted by the Heat Pump Association, based on the deployment of 300,000 heat pumps installed in 2025 and 1 million installed in 2030, suggests that 12,400 heat pump installers will be required by 2025 and 50,200 by 2030.

The current off-gas grid market is served by an installer and maintenance workforce of approximately 10,000 – 15,000 people. If heat pumps are to be the primary choice for off-gas grid households from 2026, a similar workforce will be needed.

There is currently little evidence to show how this will be achieved. While the government has announced two new support schemes (Boiler Upgrade Scheme and Home Upgrade Grant), the funding is capped at a level that will not dramatically upscale the deployment of heat pumps over the existing RHI scheme. While the announcements in the Heat and Buildings Strategy will encourage some new entrants into the heat pump installation sector, without substantially increased consumer demand, it is unlikely that significant numbers of existing heating installers will wish to enter the heat pump market.

The 2026 deadline may also have the perverse consequence of increasing demand for oil boilers as households seek to future proof their existing heating system.

Existing oil boiler installers may be busier than usual as a consequence, making it less likely that they will wish to diversify into heat pumps.

Should the heat pump installation sector not be sufficiently mature by 2026, we fear that this will impact both the quality and the cost of installations.

There is a significant risk that households requiring a new heating appliance after 2026 may face long delays due to the immaturity of the heat pump market and longer installation times compared to current fossil fuel appliances. This has already been highlighted by the BEIS (Department for Business, Energy & Industrial Strategy) electrification demonstration project. While this will be inconvenient for those where the change has been planned, it will be disastrous for those in a distress purchase situation. In these scenarios, it is essential to restore heating as quickly as possible. However, we think it is likely that there may not be enough rural heat pump installers to serve the current offgas grid market, leading to long delays.

This is evidenced by a recent poll of OFTEC registered heating technicians currently undertaking oil heating work. When asked about the proposals, only a small minority (7%) saw the changes as a welcome business opportunity and an even smaller number thought the plans were ambitious or achievable (4.5%). 77% said they thought the proposals were a bad idea.

Unlike the heat pump industry, we have a proven track record in serving rural homes. As a mature existing player in the rural heat market, we have all the necessary elements in place to deliver a renewableliquid fuel solution at scale from 2026.

The liquid fuel heating industry is in the second year of field trials and demonstrations. We are already confident that HVO will work without problems in all existing oil heating systems.

We have had in-depth conversations with a number of current and potential HVO suppliers who have assured us that there will be a sustainable supply of HVO into the UK. This is backed up in our response to the government.

We have identified that 10% of oil heating demand could be replaced by additional feedstocks such as used cooking oil collected in the UK and converted into a renewable liquid fuel. The government has recently announced the lifting of import tariffs for HVO produced in the US opening the UK to the second biggest HVO market.

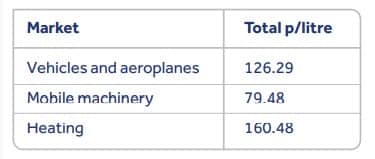

Renewable liquid fuels are significantly more expensive than the fossil fuel counterpart. These fuels are already used in vehicles, non-road mobile machinery and aircraft, and benefit from a reduction in price to the consumer of over 80p per litre through the RTFO mechanism administered by the Department for Transport.

It seems only fair and logical that a scheme with similar benefits is introduced for the home heating market.

Significant progress can be made in decarbonising oilheated homes quickly if the proposed policy is adapted to a technology inclusive approach and provides appropriate support for renewable liquid fuels.

Our industry has a proven track record in serving rural homes. As a mature existing player in the rural heat market, we have all the necessary elements in place to deliver this solution at scale.

Our customers match our enthusiasm. A recent poll of 2,676 rural households by the Future Ready Fuel campaign found that 98% would welcome the opportunity to convert to HVO.

We urge the government to work with the industry over the next few months to agree a satisfactory financial mechanism that calues home heating in hard to treat rural homes in the same way as vehicles and aircraft.

Ongoing costs

One of the primary themes identified as a barrier to the adoption of HVO as a heating oil replacement is price.

The principal reason for this is that HVO can also be used as a replacement for fuels in a variety of machines currently using fossil fuels such as vehicles, aeroplanes and mobile machinery, for example, cranes. The government treats these uses differently to home heating.

Under a government scheme called the Renewable Transport Fuel Obligation (RTFO), each litre of HVO supplied to these machines generates a Renewable Transport Fuel Certificate (RTFC), which can be traded i.e. sold to obligated parties in order to satisfy an obligation, creating a financial incentive to HVO suppliers. Currently, HVO generates credits worth 81p per litre.

The following table demonstrates the difference in end-user HVO prices:

Addressing this price disparity should form a key part of government policy. We urge the government to work with the industry over the next few months to agree on a satisfactory financial mechanism that values home heating in hard to treat rural homes in the same way as vehicles and aircraft.

Sources and security of supply

We have had in-depth conversations with a number of current and potential HVO suppliers who have assured us there will be a sustainable supply of HVO into the UK and our potential market. This is backed up by further independent

evidence.

UK production

There is currently no UK production of HVO. UKIFDA and OFTEC commissioned analysis to see how much HVO could be produced in the UK given the right government policy principally around encouraging the collection of used cooking oil. Our findings are that if all oil-heated homes were converted to HVO, then c.10% of that HVO could be produced from feedstocks collected in the UK.

European production

Currently, the main source of HVO is from Europe. Analysis suggests that European production of HVO is expected to increase from 3.5 million tonnes in 2020 to 11.30 million tonnes by 2025.

US production

Similarly, production in other parts of the world is also expected to increase substantially with most rapid growth predicted in the US with a six-fold increase. Total world production is expected to reach almost 30 million tonnes by 2025, compared to only 7 million tonnes in 2020.

Further analysis shows the number of producers of HVO to increase from five mainly European-based producers now to 13 producers distributed throughout the world by 2024.

In 2022, the US will produce more HVO than Europe for the first time. Currently, US-produced HVO incurs significant import tariffs into the UK as part of legacy European legislation, and, as a result, no US HVO has entered the UK. The UK government has recently overturned this legislation.

Sustainable Aviation Fuel

There is very little difference between kerosene used in aircraft and that used for space and water heating. The use of heating oil and jet fuel is countercyclical, with jet fuel dominant in the summer and heating oil in the winter.

In the UK, the Department for Transport has set out high level ambitions for the indigenous production of Sustainable Aviation Fuel (SAF).xx In the highest level of ambition, with 75% of fuel volumes being SAF, there will be a very high number of plants beginning to develop before 2025, and an ambition of c.125 large-scale plants in 2050.

Therefore, there is already a good economic fit to suggest that the Department of Transport and Department for Business Energy and Industrial Strategy should be working together to ensure that renewable liquid fuels can be used in both sectors.

Sustainability

We believe the existing UK and European sustainability standards are extremely high. HVO used for domestic heating purposes should comply with British Standard EN 15940, be derived from verifiable and sustainable waste sources, and be produced under strict quality assurance systems to achieve consistent quality and properties of the fuel.

For our field trial, each batch of HVO is accompanied by a proof of sustainability document, which details the raw materials used to produce the fuel and the fuel has been independently verified and certified to be sustainable and

derived from waste streams by the ISCC.

It should be noted that none of the products we use contain palm oil.

We believe that there should also be robust industry standards alongside the robust legislative standards, including audit and monitoring processes. Following our recent HVO trial, the industry intends to agree and publish a British Standard with respect to bio-liquid sustainability.

Best use of Renewable Liquid Fuels

Our view is that homes currently using oil for heating should be treated as a priority for conversion to a renewable liquid fuel replacement because of the lack of a viable alternative to decarbonise the sector.

The government has recently consulted industry on where biomass (which includes renewable liquid fuels) best contributes to decarbonisation targets and as such is looking at the possible trade-offs that need to be considered when making decisions.

The government must make these decisions not solely based on technical considerations but on what is reasonable and fair. Clear choices need to be made between a typical oil-heated home in the UK using 1800 litres of renewable liquid heating fuel annually against the equivalent powering a Boeing 737 for 28 minutes or 282 miles excluding taxiing to the runway.

The government has not provided enough real evidence that a heat pump first approach is compatible with the majority of the off-gas grid housing stock. Predominantly rural households will face high cost, disruption and delay as a consequence.

Far from achieving a smooth transition, the proposals risk undermining support for decarbonisation.

As a result, we do not support the imposition of an end date for the use of heating oil as this would adversely and unfairly impact rural households.

Given that a family living in an on-gas grid home will not face these high costs until at least 2035, we think this additional financial burden will be considered unfair by most reasonable people.

Installing heat pumps means homes will increase their electricity use and the requirement on the grid, for both high and low voltages, will increase substantially. A big concern is how grid systems will cope in rural areas, and the timescale concerning upgrades, and the ultimate cost to the consumer.

We have a proven track record in serving rural homes, unlike the heat pump industry. As a mature existing player in the rural heat market, we have all the necessary elements in place to deliver a renewable liquid fuel solution at scale.

Around 10,000 oil-heating technicians are already registered with OFTEC’s competent person scheme and have the necessary skills to convert existing homes to HVO.

Around 10,000 people in the fuel distribution industry are ready and capable of delivering the fuel to consumers’ homes as they have done for nearly a century.

We urge the government to work with the industry over the next few months to agree on a satisfactory financial mechanism that values home heating and renewable liquid fuels in very hard to treat rural homes in the same way as vehicles and aircraft.

We urge the government to present a technology inclusive approach.

For more information read more at Future ready Fuel.